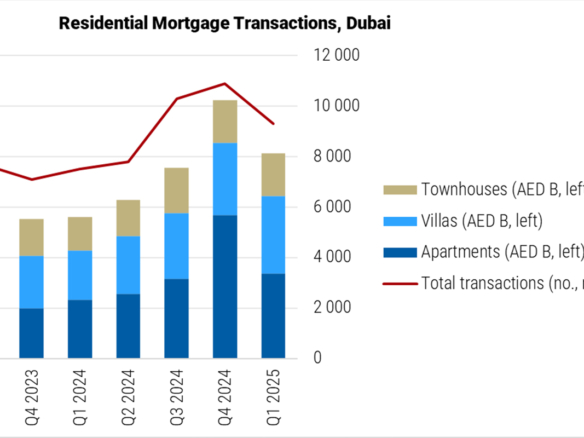

Dubai, UAE – August 2025

After years of rapid growth, Dubai’s real estate market is entering a new phase—characterized by cooling

prices, strong supply expansion, and strategic buying opportunities.

Market Outlook: Price Correction Ahead

Leading global rating agency Fitch Ratings has projected a 10–15% correction in residential property

prices across Dubai by late 2025. The reason? A historic surge in new housing supply—over 210,000 new

units are set to hit the market over the next 18 months, with 73,000 homes expected by year-end.

While some see this as a sign of saturation, seasoned investors view it as a timely market recalibration

that could unlock better value in high-demand zones.

“The current correction is not a crash—it’s a rebalancing,” says a local real estate strategist. “We’re

witnessing a shift from an overheated market to a more sustainable, investor-friendly environment.”

Strategic Buying Opportunities Emerging

Now is a key moment for investors to shift from speculative short-term plays to value-driven, long-term

strategies. Here’s how:

Target Undervalued Communities

New supply will affect some areas more than others. Prime locations like Dubai Hills Estate, Business

Bay, and JVC may see modest adjustments—while peripheral areas could experience sharper price

declines.

Investor Tip: Focus on mid-market communities with high rental demand and upcoming infrastructure

improvement

Capitalize on Off-Plan Discounts

Developers are offering attractive payment plans, DLD waivers, and post-handover incentives to stay

competitive in a crowded market.

Investor Tip: Choose escrow-protected, branded off-plan projects with proven developer track

records.

Look for High-Yield Assets

With rental demand remaining strong, especially among expats and long-term residents, properties

offering 6–8% rental yields are still attainable.

Investor Tip: Invest in fully managed units or short-term rentals in high-traffic zones like Dubai Marina

or Downtown.

What’s Driving Investor Confidence?

- GDP Growth: Dubai’s economy grew by 4% in Q1 2025, with real estate contributing significantly to GDP.

- Golden Visa Updates: Updated visa pathways make it easier for property investors to obtain long-term residency.

- Currency Advantage: A strong USD-pegged dirham continues to attract foreign investors, particularly from Europe, India, and China.

- Expo Legacy Projects: Areas around Expo City and Al Maktoum Airport continue to attract long-term infrastructural investments.

Dubai’s real estate market in Q3 2025 is shifting gears—but not slowing down. As prices adjust and

supply increases, savvy investors have a unique opportunity to enter the market with better value,

less competition, and more negotiating power.

Whether you’re looking to expand your portfolio, buy your first property, or shift from short-term flips to

rental income—now is the time to rethink your strategy.

Join The Discussion