Dubai, August 2025 — After a meteoric rise in residential property prices, analysts now anticipate

Dubai’s real estate market will undergo a significant correction by 2026, reshaping the landscape and

opening new opportunities for savvy investors.

Fitch Signals Up to 15% Price Correction

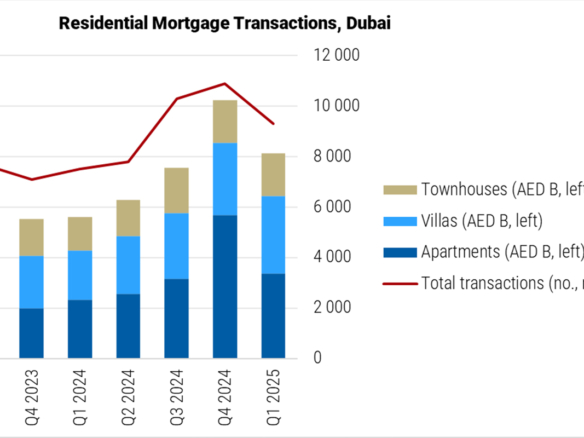

Fitch Ratings forecasts a potential 10–15% decline in residential property prices through late 2025 into

2026, following a staggering 60% surge from 2022 to early 2025. This soft landing is attributed to an

anticipated supply glut, with over 210,000 new housing units expected to flood the market over the

coming two years—double the pace of the previous three years.

Importantly, Fitch reassures that the decline is manageable: robust banking sector precautions and

consolidation among developers have fortified the market against the worst-case fallout.

Why This Is Not the 2009 Repeat

Despite echoes of 2009’s housing crash, experts emphasize the current context is fundamentally

different. Dubai’s economic expansion, investor-friendly policies, and greenery in prime-location

demand—and lingering project delays limiting supply—suggest a market reset, not collapse.

Supply vs Delivery — A Supply Myth?

While projections estimate hundreds of thousands of new units, real-world delivery may fall short.

Morgan’s Realty cautions that only a fraction of projected completions may materialize—as little as 48%

of 2026’s forecasted 71,600 units—potentially lifting the floor for prices to stay firmer than expected.

What Analysts and Developers Expect

- S&P Global Ratings sees the market “balancing out by 2026,” with prices stabilizing and possibly

easing modestly thereafter, especially in non-prime areas.

- The Luxury Playbook projects moderate appreciation through early 2026—a 3.5% to 5.2%

increase on average—but highlights mid-income zones may remain scarce, supporting

valuations.

- Across the board, projections suggest Greater Affordability, especially in evolving neighborhoods

like Creek Harbour, Dubai South, and JVC, making them hotspots for strategic, value-driven

purchases.

What It Means for Buyers and Investors

This anticipated price correction presents a golden window for long-term buyers:

- First-homebuyers and expatriates may find better entry points.

- Investors eyeing rental yields can now plan around improved affordability.

- Developers focused on location and quality—rather than speculative pricing—stand to outperform.

By 2026, Dubai’s real estate market is expected to reset and rebalance, not collapse. A blend of strong

fundamentals—economic growth, migration inflows, and robust policy frameworks—and tempered

correction dynamics sets the stage for a matured, buyer-friendly era.

This shift transforms Dubai from a high-volatility environment into a strategic investment ground,

particularly for those focusing on long-term value, sustainable development, and affordable mid-market

segments

Join The Discussion