Dubai, August 2025 — With the real estate market hotter than ever, investors are facing a crucial

decision: ready-to-move-in or off-plan properties? Each offers distinct advantages, and Dubai’s

dynamic market in 2025 makes the choice even more strategic. Here’s what you need to know before

placing your next investment bet.

Off-Plan Properties: The Future-Forward Investment

Off-plan developments have exploded in popularity thanks to affordable entry points, flexible payment

plans, and high appreciation potential. In 2024 alone, off-plan sales jumped 58%, with developers

launching ambitious projects across Dubai South, Expo City, JVC, and Meydan.

Why Go Off-Plan?

- Lower Prices: Often 15–30% cheaper than completed units.

- Flexible Payments: Pay in phases over 2–5 years.

- High ROI on Handover: Value can rise significantly by the time of delivery.

- Customization: Choose layouts, finishes, and floors before it’s built.

What to Watch For

- Delayed Handover Risks

- Uncertainty in Market Trends

- Developer Track Record Is Key — Always check RERA registration and project escrow

compliance.

Investor Tip: Off-plan is best for medium-to-long-term investors willing to wait 2–4 years for high capital

gains.

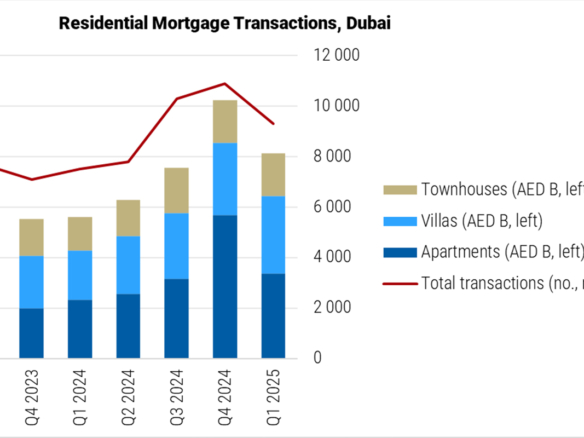

Ready Properties: Instant Returns & Peace of Mind

With Dubai’s rental market seeing double-digit growth across prime and affordable areas, ready

properties are favored by those looking for immediate returns.

Why Go Ready?

- Instant Rental Income: Start earning from day one.

- Tangible Asset: What you see is what you get—no surprises.

- Financing Is Easier: Banks offer better mortgage terms on completed assets.

- Resale Liquidity: Faster to flip in high-demand areas.

What to Consider

- Higher Upfront Cost

- Limited Customization

- Possibly Lower Capital Appreciation if bought at market peak

Investor Tip: Ready properties suit those looking for passive income or short-term gains through rental

yield or resale.

Market Snapshot: August 2025

Type

Avg Price/Sqft

Avg ROI

Buyer Profile

Off-Plan

AED 1,300–1,800

8–12% (on handover)

Long-term growth investors

Ready

AED 1,600–2,400

6–8% (immediate)

Yield-driven investors

Where’s the Action?

- Top Off-Plan Zones (2025): Dubai South, Dubai Creek Harbour, Expo Valley, Al Furjan, JVC

- Top Ready Zones (2025): Downtown Dubai, Business Bay, Marina, Arjan, Dubai Hills Estate

Final Verdict: Choose Based on Your Strategy

Your Goal

Best Pick

High ROI in 3–5 Years

Off-Plan

Passive Income Now

Ready Property

Lower Initial Investment

Off-Plan

Stability & Visibility

Ready Property

Market like Dubai, timing and strategy are everything. Whether you’re eyeing ready-to-let apartments

or off-plan launches with capital gain potential, the right choice depends on your investment horizon

and risk appetite.

With mega projects rising, population growth booming, and rental demand soaring, both off-plan and

ready assets offer exciting opportunities. The question isn’t which is better—it’s which is better for you

right now.

Join The Discussion